As a business owner or freelancer, ensuring you have accurate pay stubs is crucial. A pay stub serves as a proof of income, detailing the amount earned and the deductions made from an employee’s salary. For many, especially small business owners, the idea of purchasing expensive payroll software may seem overwhelming. The good news is that there are free paystub makers available that can help you generate professional and accurate pay stubs quickly and easily.

But with so many options out there, how do you choose the best one? In this blog, we’ll dive into the top 10 features to look for in a free paystub maker. Whether you’re a small business owner, a freelancer, or someone who just needs to create real check stubs, these features will ensure you pick the right tool for your needs.

1. Ease of Use

One of the first things you want in a free paystub maker is ease of use. You don’t need to be a payroll expert to create a pay stub. A good paystub generator should have an intuitive, user-friendly interface that allows you to enter your information quickly and efficiently. Look for a tool that doesn’t overwhelm you with too many options. The process should be simple, often involving just a few fields for you to fill in, such as the employee’s name, salary, pay period, and deductions.

Tip: If you’re a small business owner or freelancer, a straightforward and easy-to-use pay stub maker will save you time and reduce the chances of making mistakes when entering data.

2. Customizable Templates

A free paystub maker should provide you with customizable templates. Every business has its own format for pay stubs, and you may want your pay stub to include specific details such as your company logo, address, or custom deductions. Look for a pay stub generator that allows you to modify the layout and add unique elements like your company name or specific benefits offered to employees.

Customizable templates give you flexibility and allow you to generate pay stubs that align with your business’s brand and structure.

3. Accurate Calculations

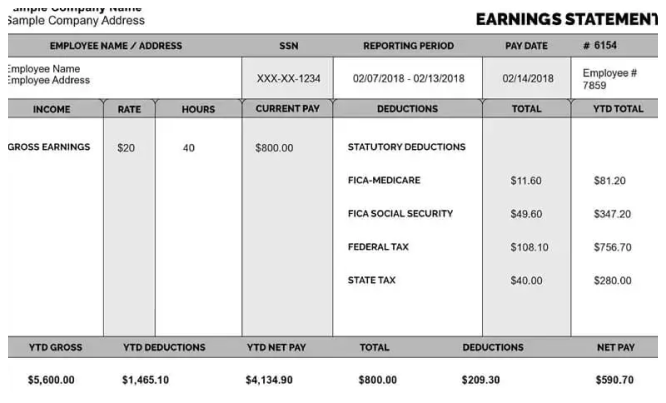

When creating a pay stub, accurate calculations are essential. A good free pay stub maker will automatically calculate taxes, deductions, and other important figures like overtime pay, net pay, and gross pay based on the information you provide. The last thing you want is to make an error in these calculations, which can lead to issues with your employees or even legal problems.

Ensure the paystub maker uses the latest tax rates for your state and federal regulations. A real check stubs maker should handle tax calculations, Social Security, Medicare, and other mandatory deductions with ease.

4. Multiple Payment Types

Not all employees are paid the same way. Some receive hourly wages, while others receive a fixed salary, commissions, or bonuses. A free pay stub generator should accommodate different payment types, so you can create accurate pay stubs no matter how your employees are compensated.

Look for a tool that allows you to enter hourly rates, salary amounts, commission percentages, and other income types. This ensures that your pay stubs are tailored to your specific business needs.

5. Tax and Deduction Support

Taxes and deductions are a significant part of any pay stub. A good free paystub maker will allow you to easily add federal, state, and local tax information, along with other deductions like insurance premiums, retirement contributions, and garnishments.

Having a tool that automatically calculates these deductions helps reduce errors and ensures your pay stubs are compliant with government regulations. Whether you are calculating federal income tax, Social Security, or Medicare deductions, make sure the paystub generator takes these into account.

6. Secure and Private

Security is crucial when dealing with sensitive employee information. Pay stubs contain private data such as salary information, tax details, and social security numbers. A free paystub maker should offer a secure environment, using encryption to protect this information from potential breaches.

Choose a pay stub generator that prioritizes privacy and security, ensuring that your employees’ data is safe from unauthorized access.

7. Download and Print Options

Once you’ve created a pay stub, you need to be able to download it in a common format (like PDF or Excel) and print it out if necessary. A reliable free paystub maker should offer a simple way to download and print your pay stubs directly from the platform.

Additionally, you should be able to save the pay stubs for future reference, making it easy to keep track of previous pay periods.

8. Unlimited Pay Stub Generation

When using a free pay stub generator, make sure it offers the ability to generate unlimited pay stubs without additional charges. Some paystub makers offer limited functionality or only allow you to create a certain number of pay stubs before asking for a subscription fee.

Look for a platform that allows you to create as many pay stubs as you need, whether you’re running payroll for a small team or managing multiple employees.

9. Compatibility with Different Devices

In today’s digital world, your tools must work across different devices. A great free pay stub maker should be compatible with desktop computers, laptops, tablets, and smartphones. Whether you’re at your desk or on the go, you should be able to generate pay stubs whenever you need them.

Make sure the platform is mobile-friendly and works well on all devices. This flexibility allows you to manage your payroll and generate pay stubs no matter where you are.

10. Customer Support

Even with the best free paystub maker, you might run into questions or technical issues. A strong customer support team can make all the difference. Look for a pay stub generator that offers reliable customer support through email, live chat, or a knowledge base.

Responsive customer service can help you troubleshoot any problems, ensure you’re using the tool correctly, and guide you through any issues that arise. Good customer support ensures you’re not left in the dark when you need help.

Bonus Tip: Compliance with Legal Requirements

Lastly, it’s crucial that the paystub maker complies with labor laws and regulations. Some states require specific information to be included in pay stubs, such as total hours worked, rate of pay, and overtime. A good free paystub maker will be up-to-date with local and federal laws, ensuring your pay stubs meet all necessary legal requirements.

Before using any paystub maker, verify that it complies with the legal standards in your state. This helps you avoid any potential legal issues down the road.

Conclusion

Whether you’re a small business owner or a freelancer, having access to a free paystub maker with the right features can save you time, reduce stress, and ensure that your pay stubs are accurate and compliant. Look for a tool that offers ease of use, customizable templates, accurate calculations, tax and deduction support, security, and mobile compatibility. These features will help you create professional and reliable pay stubs quickly and without any hassle.

With the right real check stubs maker, you can efficiently manage your payroll, maintain compliance, and provide your employees with transparent and accurate pay stubs. The best part is, you don’t need to spend a fortune on payroll software when so many free options are available!

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

Leave a Reply