As a contractor, keeping track of your income and expenses is critical to running a successful business. Unlike traditional employees, contractors don’t receive regular paychecks from a single employer. Instead, they often work with multiple clients and get paid at different times and in various amounts. This can make managing income and tracking payments a bit more complex.

Fortunately, there’s a simple solution that can help contractors stay organized and ensure they’re paid accurately — free paycheck creators. These tools not only help you generate pay stubs but also assist in tracking your earnings, deductions, and taxes, making financial management easier. In this blog, we’ll explore how free paycheck creators can simplify income tracking for contractors, helping you stay on top of your finances and save valuable time.

The Challenge of Income Tracking for Contractors

Contractors face unique challenges when it comes to income tracking. Here are a few reasons why it can be more complicated compared to traditional employees:

-

Multiple Clients and Projects

Unlike employees who work for a single employer, contractors often juggle multiple clients at once. Each client may have different payment schedules, rates, and expectations for invoicing. This can make it hard to keep track of which payments have been received, which are due, and how much income you’ve generated overall. -

Variable Income

Contractor pay is often irregular. Some months, you might earn a lot, while other months might be slower. This variability can make it harder to manage your cash flow, especially if you rely on the income to cover personal and business expenses. -

Self-Employment Taxes

As a contractor, you are responsible for paying your own taxes. This means you need to keep track of your income and expenses throughout the year to ensure that you pay the right amount of taxes when tax season arrives. Failing to track your earnings accurately can result in underpayment or overpayment, both of which can lead to financial problems down the road. -

No Withholding from Clients

Unlike employees, who have taxes automatically withheld from their paychecks, contractors typically receive their full earnings without deductions. This means contractors need to manage their own tax contributions, retirement savings, and other deductions.

Given these challenges, it’s clear that contractors need a simple and efficient way to track their income and manage their financial records. This is where a free paycheck creator can help.

How a Free Paycheck Creator Can Help Contractors

A free paycheck creator is a powerful tool designed to simplify the process of generating pay stubs and tracking earnings. By using these tools, contractors can manage their income more effectively and stay organized, regardless of the number of clients they work with. Let’s take a closer look at how these tools can benefit contractors.

1. Generate Pay Stubs for Each Client and Job

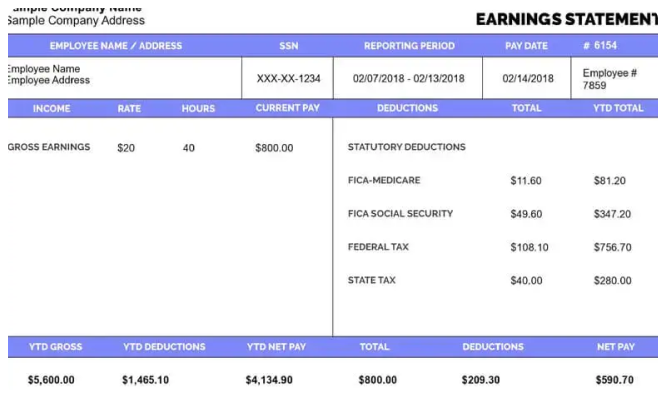

With a free paycheck creator, contractors can generate a detailed pay stub for each client or project. Each pay stub will include:

- Client/Project Name: Helps you track which income came from which client.

- Gross Earnings: The total amount you earned for that particular project or job.

- Deductions (if applicable): Even though contractors generally don’t have taxes withheld from their earnings, you may still have business-related expenses to deduct, such as equipment costs or health insurance premiums.

- Net Pay: The amount you take home after deductions (if any).

- Payment Date: The date on which the payment was made or is due.

By having a detailed record of each payment, you can track your income more easily, and you’ll have everything you need when tax season arrives. This is especially useful for contractors who work with multiple clients, as it provides an organized record of payments and deductions.

2. Track Payments and Outstanding Invoices

Contractors are often paid after the work is completed, meaning there could be a gap between finishing a project and receiving payment. Sometimes, clients may even delay payments or fail to pay on time.

Using a free paycheck creator, you can generate pay stubs to track both the payments you’ve received and the ones that are still pending. For each job, you can input the agreed-upon payment terms and track whether the client has paid you or if the invoice is still open.

Some paycheck creators allow you to generate invoices as well, which can further streamline the payment process. You can include your payment terms, details of the services provided, and payment due dates, all in one place. This way, you have everything you need to follow up with clients and ensure timely payments.

3. Manage Tax Withholding and Deductions

As a contractor, you’re responsible for setting aside money for taxes. While you don’t have taxes automatically withheld from your income, it’s important to track your earnings and calculate how much you should set aside for self-employment taxes, Social Security, Medicare, and other deductions.

Some free paycheck creators offer tools that help you calculate these deductions. By entering your income for each job, you can get an estimate of how much you need to save for taxes. This helps you avoid surprises at tax time and ensures you’re always prepared to pay your taxes on time.

Moreover, many paycheck creators allow you to input your own deductions, such as contributions to retirement accounts or health insurance premiums. Keeping track of these deductions is crucial for contractors who want to maximize their tax savings and prepare for future expenses.

4. Simplify Record-Keeping and Organization

Keeping your financial records organized is one of the most important tasks for contractors. A free paycheck creator helps by providing a clear, concise record of all your earnings, deductions, and taxes in one place. You can easily access pay stubs and invoices from past projects, making it easier to track your progress and monitor cash flow.

For contractors who are working on multiple projects or clients at once, this organization is particularly valuable. You won’t need to dig through piles of invoices or emails to find information — everything will be in one convenient place.

Moreover, having well-organized pay stubs and income records can be helpful if you ever need to apply for a loan, mortgage, or business financing. Lenders and financial institutions often require proof of income, and having professional, accurate pay stubs can make this process smoother.

5. Create Professional Pay Stubs for Clients

If you need to provide your clients with proof of payment or income, a free paycheck creator can help you generate professional pay stubs that you can send directly to them. This adds a level of professionalism to your work and helps build trust with clients.

Having a pay stub to share with clients shows that you’re organized and serious about your work. It also gives your clients a transparent breakdown of your rates, hours worked, and payments made, which can help avoid misunderstandings or disputes about compensation.

6. Stay on Top of Your Finances

By consistently using a paycheck creator, you’ll have a better understanding of your finances. You’ll be able to see how much you’re earning each month, how much you’re saving for taxes, and whether you’re meeting your financial goals.

This ongoing tracking also helps you identify any payment issues early on. If a client is consistently late with payments or if you’re not earning as much as you expected, you’ll be able to spot these trends and make adjustments to your business practices.

Key Features to Look for in a Free Paycheck Creator for Contractors

Not all free paycheck creators are the same. When choosing a tool, it’s important to look for features that will help you manage your unique contractor needs. Here are some key features to consider:

- Customizable Pay Stubs: Make sure the tool lets you customize pay stubs to fit your business. You should be able to add client names, project descriptions, and any applicable deductions.

- Tax Calculations: Look for a creator that includes tax calculations for self-employed individuals, such as estimated federal and state tax withholdings, Social Security, and Medicare.

- Multiple Client Support: If you work with several clients, the tool should allow you to track income from each one separately.

- Invoice Generation: Some paycheck creators allow you to create invoices directly through the platform. This can be especially useful if you want to streamline both payment tracking and client billing.

- User-Friendly Interface: Choose a tool that is easy to use and doesn’t require extensive technical knowledge. The simpler, the better!

- Mobile Accessibility: Some free paycheck creators offer mobile apps, allowing you to manage your income and generate pay stubs on the go.

Final Thoughts

Income tracking can be one of the most challenging aspects of being a contractor. From handling multiple clients and irregular payments to managing taxes and deductions, contractors have a lot on their plates. However, by using a free paycheck creator, you can simplify this process and gain better control over your finances.

With the right tools, you’ll be able to generate pay stubs, track your earnings, manage deductions, and stay organized. Whether you’re working with one client or several, a free paycheck creator can save you time, reduce stress, and help ensure that you’re paid fairly for your hard work.

So, if you’re a contractor looking to streamline your income tracking, give a free paycheck creator a try. It could be the key to keeping your finances in check and helping your business grow.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Leave a Reply