As a business owner or manager, one of your key responsibilities is ensuring your employees are paid correctly and on time. While payroll can be complex—especially when dealing with hourly rates, overtime, bonuses, and taxes—generating check stubs for your employees doesn’t have to be a time-consuming or difficult process. In fact, with the right tools, you can generate accurate, professional check stubs for your employees in just a few minutes.

In this blog, we’ll explore how you can use a check stub maker to simplify the process of creating pay stubs, ensuring that your employees are paid accurately and that your business stays compliant with payroll laws. We’ll cover the benefits of using a check stub maker, provide a step-by-step guide on how to generate check stubs, and discuss how this tool can save you time and reduce payroll errors.

What Are Check Stubs and Why Are They Important?

Before diving into how to generate check stubs, let’s first define what check stubs are and why they’re important.

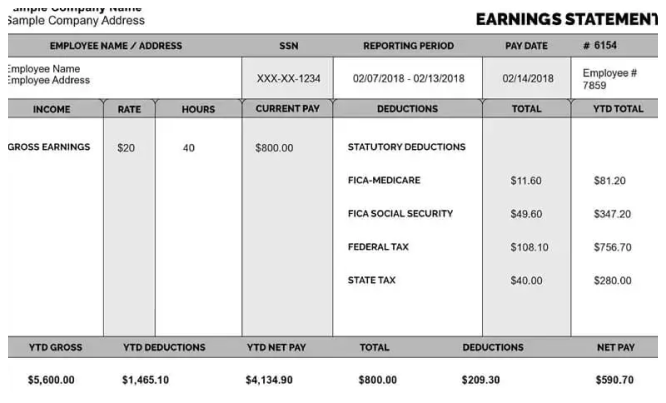

A check stub is a document that accompanies a paycheck and outlines an employee’s earnings and deductions for a specific pay period. It breaks down the following key information:

- Gross earnings: The total amount an employee earned before any deductions (hourly wage multiplied by hours worked, salary, or commission).

- Deductions: This includes taxes (federal, state, and local), Social Security, Medicare, retirement contributions, insurance premiums, and other voluntary or mandatory deductions.

- Net pay: The take-home amount the employee receives after all deductions.

- Other details: Check stubs also often include information like the employee’s name, the employer’s name, the pay period, and the number of hours worked (for hourly employees).

For businesses, providing check stubs is not only a good practice but often a legal requirement, as it helps employees track their earnings and deductions. It also ensures that businesses comply with tax laws by providing an official record of wages paid.

The Role of a Check Stub Maker

A check stub maker is an online tool that automates the creation of pay stubs. Whether you run a small business with just a few employees or manage a larger team, a check stub maker can generate accurate and professional pay stubs in minutes.

These tools allow you to input the necessary information (such as employee earnings, deductions, and hours worked), and they automatically calculate the final numbers and create a pay stub based on the data you provide. Most check stub makers offer templates that you can customize, making it easy to match your company’s branding and ensure all required information is included.

Benefits of Using a Check Stub Maker

Using a check stub maker offers several advantages for business owners and HR departments. Here are some key benefits:

1. Saves Time

Manually creating pay stubs for every employee can be time-consuming, especially if you’re processing payroll for multiple workers or paying on a bi-weekly or monthly basis. A check stub maker streamlines the process, allowing you to create accurate pay stubs in just a few minutes.

By automating calculations for earnings, deductions, taxes, and benefits, a check stub maker removes the guesswork and ensures efficiency. Instead of spending hours inputting data into spreadsheets or dealing with complex payroll software, you can create multiple check stubs in just a few clicks.

2. Reduces Errors

Human error is one of the most common causes of payroll mistakes. A typo in the hours worked, an incorrect tax calculation, or missed deductions can lead to payroll discrepancies, frustration, and even legal issues. A check stub maker reduces the chance of errors by automating calculations and providing templates that adhere to legal requirements.

With a check stub maker, all you need to do is input accurate data, and the tool will take care of the rest. This greatly reduces the risk of payroll mistakes, ensuring your employees are paid correctly and your business stays compliant with payroll laws.

3. Professional and Accurate Documents

A check stub maker creates professional-looking pay stubs that include all the necessary details in a clear and organized format. These documents can be customized with your business logo and branding, adding a level of professionalism to your payroll process.

In addition, a check stub maker ensures that all required information—such as gross pay, deductions, and net pay—is included, which helps employees understand how their pay was calculated and makes it easier for them to keep track of their earnings.

4. Helps with Legal Compliance

In the U.S., businesses are required to provide pay stubs in many states, and these pay stubs must contain specific information. By using a check stub maker, you can ensure that your pay stubs meet both state and federal legal requirements. Most check stub makers stay up to date with changes in tax laws and ensure compliance by including all the necessary information and calculations.

Failure to comply with legal requirements can lead to penalties and fines, so using a tool that generates compliant pay stubs helps protect your business from potential legal issues.

5. Convenient Access and Digital Storage

Most check stub makers allow you to download pay stubs in a digital format (usually PDF), making it easy to store and share them electronically. This reduces paper waste and makes it easier to access pay stubs in the future if you or your employees need them for tax purposes or loan applications.

With digital pay stubs, you can email them to employees directly, allowing for quicker distribution. Plus, employees can easily download and save their pay stubs for their personal records.

How to Generate Check Stubs for Your Employees in Minutes

Now that we understand the benefits of using a check stub maker, let’s walk through the process of generating check stubs for your employees in just a few simple steps.

Step 1: Choose a Check Stub Maker

There are many check stub makers available online, so the first step is to choose the one that best fits your business needs. When selecting a tool, look for the following features:

- Ease of use: The tool should be easy to navigate and intuitive, even for those who aren’t familiar with payroll processes.

- Customization options: The ability to add your business logo, adjust pay stub layouts, and choose from different templates is essential for branding and compliance.

- Tax calculations: A good check stub maker will automatically calculate tax deductions, overtime, and other deductions based on your input.

- Security: Choose a tool that ensures your data is secure and protected.

Step 2: Input Employee Information

Once you’ve selected a check stub maker, the next step is to input your employee’s information. You will typically need to enter the following details:

- Employee’s name: This ensures the pay stub is correctly associated with the right person.

- Pay period: Enter the dates for the start and end of the pay period (e.g., bi-weekly, monthly).

- Hourly rate or salary: For hourly employees, input the hourly rate and total hours worked. For salaried employees, input their fixed salary amount.

- Deductions: Include details for taxes, insurance, retirement plan contributions, and other relevant deductions.

Step 3: Add Bonus or Overtime Pay (If Applicable)

If your employee is entitled to overtime pay or a bonus, most check stub makers allow you to enter this information as well. For overtime, ensure that you input the correct number of overtime hours worked and the applicable overtime rate. For bonuses, input the bonus amount.

Step 4: Generate the Check Stub

Once you’ve input all the necessary data, click on the “Generate” or “Create” button. The check stub maker will calculate the earnings, deductions, and taxes and generate a professional-looking pay stub in seconds.

Step 5: Review and Download

Take a moment to review the generated pay stub. Make sure the gross pay, deductions, and net pay are accurate. If everything looks good, download the pay stub in PDF format. You can then email it to your employee or print it out for physical distribution.

Step 6: Store the Pay Stub

Lastly, save a copy of the pay stub in your digital records for future reference. Storing pay stubs digitally is not only more efficient but also helps with compliance in case of audits or tax filings.

Conclusion

Generating accurate check stubs for your employees doesn’t have to be a time-consuming or error-prone process. With a check stub maker, you can automate the payroll process, ensuring your employees are paid on time and that your business stays compliant with tax laws.

By choosing the right check stub maker and following a few simple steps, you can create professional pay stubs for your employees in just a few minutes, saving time, reducing errors, and enhancing your business’s professionalism. Whether you’re a small business owner or manage a larger team, using a check stub maker is a smart choice for simplifying payroll management and ensuring accuracy.

Leave a Reply