In today’s fast-paced world, managing finances efficiently is essential for both individuals and businesses. Whether you are an employee who wants to keep track of your earnings or a business owner who needs to issue pay stubs to employees, having an accurate and reliable paycheck stub is important. Fortunately, a free paycheck creator is available online to help make this process easier and more cost-effective.

In this blog, we will walk you through how to use free paycheck stub creators, their benefits, and how they can be useful for both personal and business purposes.

What is a Paycheck Stub?

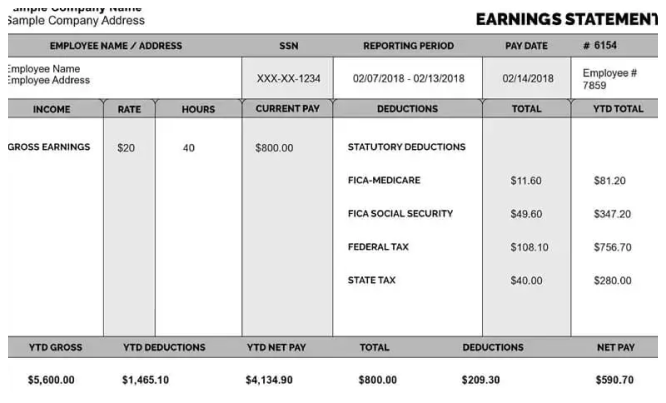

Before diving into how to use a free paycheck stub creator, it’s important to understand what a paycheck stub is. A paycheck stub is a document that details the breakdown of an employee’s wages. It shows how much the employee earned during a specific pay period and provides detailed information on various deductions such as taxes, insurance premiums, retirement contributions, and more.

The paycheck stub usually accompanies the paycheck and is essential for both employees and employers. For employees, it helps track earnings, tax withholding, and deductions. For employers, it serves as a legal document that records payroll information.

Why Use a Free Paycheck Stub Creator?

If you’re someone who needs to create paycheck stubs regularly or just on occasion, you might be wondering why you should use a free paycheck stub creator. Here are some reasons why it might be beneficial:

-

Cost-Effective

Most businesses pay for payroll software or hire accountants to generate paycheck stubs. However, for individuals or small businesses on a budget, using a free paycheck stub creator can save you money. These tools allow you to create accurate stubs without incurring additional costs. -

Convenience and Time-Saving

A free paycheck stub creator is fast and easy to use. Whether you’re an employee or a business owner, you can quickly generate a paycheck stub in minutes. There’s no need for manual calculations or expensive payroll services. -

Professional Output

Many free paycheck stub creators provide templates that look professional and clean. This is important for businesses, as employees may need to use these stubs for various purposes, including applying for loans, renting apartments, or for tax filing. -

Record Keeping

Paycheck stubs help both employees and employers maintain accurate financial records. For employees, stubs provide a historical record of income, and for business owners, they provide proof of payroll for tax purposes or audits. -

Compliance

If you’re an employer, providing paycheck stubs is often a legal requirement. Using a free paycheck stub creator ensures that your business stays compliant with labor laws and that employees receive the information they are entitled to.

How to Use a Free Paycheck Stub Creator

Using a free paycheck stub creator is typically very straightforward. Here’s a step-by-step guide to help you get started.

Step 1: Choose the Right Free Paycheck Stub Creator

There are many free paycheck stub creators available online. When selecting a tool, consider these factors:

- Features: Look for tools that offer essential features, such as customizable templates and accurate tax calculations.

- Ease of Use: Choose a user-friendly interface that allows you to generate paycheck stubs quickly and easily.

- Accuracy: Make sure the tool offers accurate tax calculations based on federal and state tax rates. This is crucial to ensure the paycheck stub reflects the correct amount of deductions.

- Security: Ensure that the website uses encryption and other security features to protect your data.

Step 2: Enter Employee Information

Once you’ve chosen a free paycheck stub creator, the next step is to input the necessary employee details. This includes:

- Employee’s Name: Full name of the employee receiving the paycheck.

- Employee ID (if applicable): An ID assigned to the employee by the business.

- Address: This may be required on some paycheck stubs, depending on the template.

- Pay Period: Specify the start and end dates of the pay period for which the paycheck is being issued.

- Pay Date: This is the date the employee will receive their paycheck.

Step 3: Input Payment Information

Next, you’ll need to enter the earnings information, including:

- Hourly Wage or Salary: If the employee is paid by the hour, input the hourly rate and the number of hours worked. If they are salaried, enter their total salary amount for the pay period.

- Overtime (if applicable): If the employee worked overtime, calculate the overtime pay and input it into the system.

- Bonuses or Commissions (if applicable): Some employees may receive bonuses or commissions, which should also be included in the paycheck stub.

Step 4: Add Deductions

After entering the earnings, the next step is to input deductions. Common deductions include:

- Federal and State Taxes: These are required by law and should be deducted based on the employee’s income and tax status.

- Social Security and Medicare: These are standard deductions in the U.S. that are also deducted from an employee’s paycheck.

- Health Insurance: If the company provides health benefits, the premium will be deducted from the employee’s paycheck.

- Retirement Contributions: Many employees have contributions to a 401(k) or other retirement plan that should be deducted from their pay.

- Other Deductions: These could include things like union dues, garnishments, or personal loans.

Step 5: Review and Generate the Paycheck Stub

After entering all the relevant information, double-check the details for accuracy. Make sure the calculations are correct and all deductions are listed. Once you’re satisfied with the data, you can generate the paycheck stub. Some creators also give you the option to preview the stub before finalizing it.

Step 6: Download and Print the Paycheck Stub

Once the paycheck stub is generated, you can usually download it as a PDF file. From there, you can print it for your records or share it electronically with the employee. Some free paycheck stub creators also allow you to save the document directly to cloud storage for easy access in the future.

Benefits for Personal Use

If you’re an employee or self-employed individual, a free paycheck stub creator can be particularly useful for managing your personal finances. Here’s how:

-

Track Your Income: A paycheck stub creator allows you to monitor your income over time, ensuring that your earnings are accurately reflected and that no deductions are missed.

-

Tax Filing: When it comes time to file taxes, having a record of your paycheck stubs can help you accurately report your income and deductions. If you’re self-employed, generating paycheck stubs can also make it easier to track your estimated tax payments.

-

Loan Applications: Some lenders may ask for recent paycheck stubs when you apply for a loan or mortgage. Having a digital record of your earnings ensures that you can quickly provide the necessary documentation.

-

Budgeting and Financial Planning: Paycheck stubs are a great tool for budgeting and planning your finances. By regularly reviewing your stubs, you can better understand your financial health and make adjustments to your spending.

Benefits for Businesses

For businesses, using a free paycheck stub creator is a great way to streamline payroll management. Here’s how it benefits employers:

-

Time-Saving: Instead of manually calculating payroll, a paycheck stub creator does the heavy lifting for you. This can save a considerable amount of time, especially for small businesses with a few employees.

-

Legal Compliance: Employers are required by law to provide paycheck stubs to employees. Using a paycheck stub creator ensures that you meet legal requirements and avoid any potential fines.

-

Transparency: By providing employees with clear and accurate paycheck stubs, you build trust and transparency within your organization. Employees will appreciate knowing exactly how their pay is calculated.

-

Record Keeping: Paycheck stubs are essential for maintaining accurate financial records. They can be used for tax filing, audits, or other official purposes.

Tips for Using Paycheck Stub Creators

- Double-check Your Data: Always review the information before finalizing the paycheck stub. Mistakes in tax calculations or earnings can lead to issues down the line.

- Use Reputable Websites: Stick to well-known, secure sites to ensure the accuracy of the paycheck stub and protect your personal or business data.

- Save Records: Always save a copy of the paycheck stubs for future reference. Both employees and employers should maintain these records for at least a few years.

Conclusion

Free paycheck stub creators are incredibly valuable tools for both personal and business use. They make it easy to generate accurate and professional-looking paycheck stubs without the need for expensive software or accountants. Whether you’re an employee who needs to keep track of your earnings or a business owner who needs to issue pay stubs regularly, these free tools can save you time, money, and effort.

By following the steps outlined above and keeping in mind the benefits of using a free paycheck stub creator, you can ensure that your paycheck management process is both efficient and compliant. So go ahead, explore the available tools, and take control of your payroll process today!

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Leave a Reply