Starting a new business is an exciting journey, but it comes with many challenges. One of the most important aspects of running a startup is managing your employees, which includes ensuring they are paid correctly and on time. This is where a paystub creator can make a huge difference. Not only does it streamline payroll, but it also plays a key role in helping startups manage and track employee benefits.

In this blog, we’ll explore how paystub creators can assist startups with managing employee benefits efficiently, ensuring accuracy, transparency, and compliance in the process. Whether you’re a new business owner or you’re considering ways to improve your payroll system, understanding the value of a paystub creator can be a game-changer.

What Is a Paystub Creator?

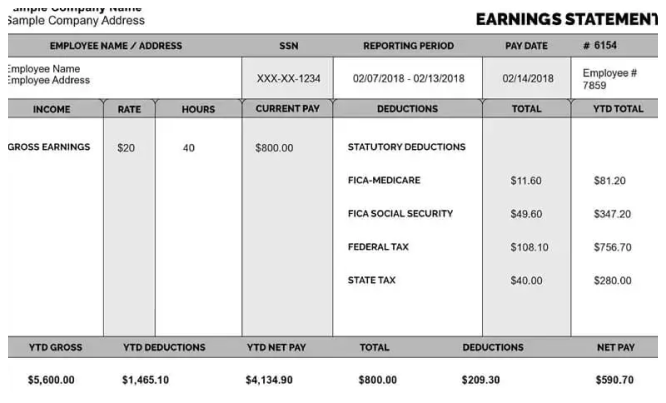

A paystub creator is an online tool or software that allows businesses to generate professional pay stubs for their employees. These pay stubs provide detailed information about an employee’s earnings, including gross pay, deductions, taxes, and the net pay they receive. The paystub creator simplifies the payroll process by automating the calculations involved and offering customizable templates that fit the specific needs of your business.

For startups, managing employee benefits can be a complex and time-consuming task. A paystub creator not only makes it easier to calculate pay but also helps businesses keep track of various benefits, deductions, and contributions.

The Importance of Employee Benefits in Startups

As a startup owner, offering competitive employee benefits is one of the best ways to attract and retain talent. Benefits can range from health insurance and retirement plans to paid time off, bonuses, and more. However, managing these benefits can be challenging for startups that are just getting off the ground.

For a startup to thrive, it is essential to keep employee satisfaction high, and benefits are a huge part of that. Having a clear system to manage these benefits ensures that employees feel valued and helps maintain a positive work environment.

But with limited resources, handling the complexities of payroll and employee benefits manually can lead to errors, confusion, and inefficiency. This is where a paystub creator can provide much-needed support.

How Paystub Creators Help Manage Employee Benefits

A paystub creator is an invaluable tool for startups when it comes to managing employee benefits. Here’s how it can help:

1. Automating Deductions for Benefits

Startups often provide employees with benefits such as health insurance, retirement contributions, or stock options. These benefits usually require deductions from an employee’s salary. Manually calculating these deductions each pay period can be time-consuming and prone to errors.

A paystub creator automates these calculations, ensuring that the correct amount is deducted for benefits every pay period. Whether you’re deducting contributions for health insurance premiums, retirement savings, or other benefits, a paystub creator does the math for you, saving you time and effort.

Moreover, the tool ensures that the right deductions are made according to the plan your company offers, reducing the chances of human error.

2. Providing Transparency

Transparency is critical when it comes to employee benefits. Employees need to understand how their benefits are being calculated and how much they are contributing to their benefits. Paystubs created using a paystub creator provide a detailed breakdown of an employee’s earnings and deductions.

For example, a pay stub will show the specific amount deducted for health insurance, 401(k) contributions, or other benefits. This transparency helps employees feel confident about how their pay is being handled and assures them that the deductions are accurate.

A paystub creator can also make it easier to track changes to benefits, such as increasing the employee contribution toward their 401(k) or changing the amount deducted for insurance premiums. This level of transparency fosters trust between the employer and employee, which is essential for employee retention.

3. Tracking Benefit Accruals

Tracking benefits like paid time off (PTO), sick leave, and vacation days can be a challenge for startups that don’t have the resources of larger companies. Employees need to know how much time they’ve accrued and how much they’ve used, and this needs to be reflected on their pay stubs.

A paystub creator can track these accruals automatically, reducing the administrative burden on HR. For instance, the paystub creator can calculate how much PTO or sick leave an employee has earned during the pay period and display this information clearly on their pay stub.

This feature not only helps employees see how much time off they’ve earned, but it also makes it easier for HR to manage the records, especially as the company grows.

4. Ensuring Legal Compliance

Compliance with labor laws and tax regulations is crucial for any business, and startups are no exception. Different states and industries have specific rules regarding employee benefits, such as mandatory sick leave or contributions to retirement plans.

A paystub creator can help ensure that your payroll system is compliant with local, state, and federal regulations. For example, the tool will automatically apply the correct tax rates, manage required deductions, and ensure that any benefits contributions comply with legal standards.

For startups that may not have a dedicated HR or legal team, a paystub creator can help minimize the risk of non-compliance by staying up to date with changing regulations and automating the necessary adjustments to payroll and benefits.

5. Generating Custom Reports

Startups often need detailed reports to track employee benefits, costs, and deductions over time. Custom reports generated by a paystub creator provide business owners with clear, organized data that helps in making financial decisions.

For example, you may want to know how much your business is spending on employee health insurance or retirement contributions. With a paystub creator, you can generate reports that show total benefit costs, employee deductions, and employer contributions for a specific time period. This information is vital for budget planning and ensures you stay within your financial means while offering valuable employee benefits.

6. Streamlining Open Enrollment

Open enrollment is the period when employees can sign up for or make changes to their benefits plans, such as health insurance or retirement contributions. This process can be complicated, especially for startups that may not have an HR team dedicated to managing open enrollment.

A paystub creator can help simplify the process by tracking changes to benefits during open enrollment. Employees can update their benefit selections, and the paystub creator will automatically adjust the deductions and contributions on their pay stubs. This reduces the manual work involved in processing open enrollment changes and ensures that everything is recorded correctly.

7. Improving Communication with Employees

A paystub creator can help improve communication between the employer and employees regarding benefits. Because the pay stubs are clear, detailed, and easy to read, employees can better understand their benefits and ask any questions they may have.

If there is ever any confusion about benefits deductions or accruals, employees can refer to their pay stubs for clarification. Having a system in place that provides transparency and easy access to benefit information improves employee satisfaction and reduces misunderstandings.

Choosing the Right Paystub Creator for Your Startup

While paystub creators can offer a range of features to help manage employee benefits, it’s important to choose the right tool for your startup’s specific needs. When selecting a paystub creator, look for the following features:

- Customization Options: Ensure the tool allows you to customize pay stubs to include all the relevant benefits information for your employees.

- Ease of Use: The software should be intuitive and easy to use, even for small business owners who may not have a payroll background.

- Compliance Features: Make sure the paystub creator stays updated with the latest legal and tax regulations.

- Benefit Tracking: Choose a tool that can track and report on employee benefits, including PTO and insurance contributions.

- Integration Capabilities: If you use other HR or accounting software, look for a paystub creator that integrates seamlessly with these tools.

Conclusion

Managing employee benefits can be a challenging task for any startup, especially when resources are limited. However, a paystub creator can simplify this process by automating calculations, ensuring compliance, providing transparency, and offering customizable reports.

With a paystub creator, your startup can easily track employee benefits, keep accurate records, and improve communication with employees. This tool helps your business run smoothly while keeping your employees satisfied and informed about their benefits.

For startups looking to streamline payroll and benefits management, a paystub creator is an essential tool. By implementing this system, you not only improve efficiency but also contribute to building a positive, transparent workplace culture.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown

Leave a Reply