For HR teams, managing payroll can be one of the most complex and time-consuming tasks. Ensuring that employees are paid correctly, on time, and in compliance with tax regulations requires precision and organization. The stakes are high—payroll mistakes can lead to employee dissatisfaction, legal troubles, and financial penalties. Fortunately, free paycheck creator tools have emerged as a game-changer for HR teams across various industries. These tools automate the payroll process, reduce the risk of errors, and free up valuable time for HR professionals.

In this blog, we’ll explore how HR teams can simplify payroll management with free paycheck-creator tools. We’ll look at the key features to look for in these tools, how they can benefit HR teams, and tips for getting the most out of them.

What is a Free Paycheck Creator?

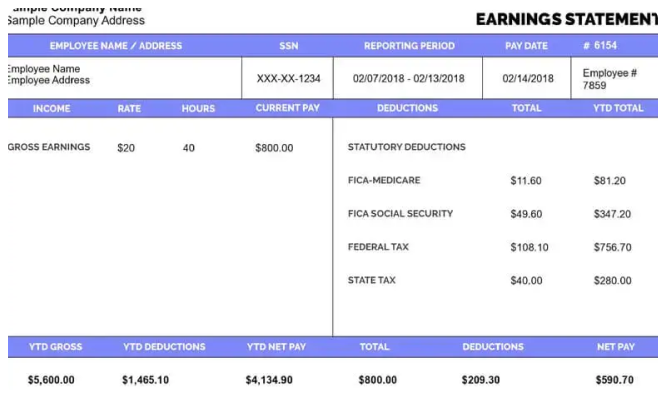

A paycheck creator is an online tool that allows businesses to generate paychecks or pay stubs for their employees. These tools are designed to automate the payroll process, ensuring that all necessary information—such as wages, hours worked, tax deductions, and benefits—is correctly calculated and presented in a professional format. A free paycheck creator offers these services at no cost, making them a valuable resource for small to medium-sized businesses or organizations looking to simplify payroll without investing in expensive software or systems.

Why HR Teams Need Paycheck Creators

Managing payroll manually can be an overwhelming task, especially when dealing with different employee types (full-time, part-time, contractors, etc.) and various wage structures (hourly, salaried, commission-based). HR teams often find themselves juggling calculations for overtime, tax deductions, bonuses, and benefits, all while making sure they comply with federal and state laws.

Here’s why HR teams should consider using free paycheck creator tools to streamline payroll management:

1. Time Efficiency

One of the biggest advantages of using a free paycheck creator is the time savings. Manually calculating hours worked, deductions, taxes, and bonuses can take hours. With an automated tool, HR teams can generate accurate paychecks in a fraction of the time. This frees up HR staff to focus on other important tasks, such as employee engagement, recruitment, and compliance.

2. Accuracy and Compliance

Payroll errors can be costly for both businesses and employees. Simple mistakes—like incorrectly calculating overtime, missing tax deductions, or failing to account for benefits—can lead to disputes, unhappy employees, and even penalties. Free paycheck creator tools automate these calculations, ensuring that all deductions are correctly applied and that the paychecks are accurate. These tools are typically updated regularly to ensure compliance with the latest federal, state, and local tax laws.

3. Cost Savings

For many small to medium-sized businesses, payroll software can be expensive, especially when you factor in additional fees for features like tax filing or advanced reporting. Free paycheck creator tools offer a budget-friendly alternative, allowing businesses to handle payroll without incurring significant costs. This is especially beneficial for startups and small businesses that are looking to save on overhead costs.

4. Improved Employee Satisfaction

Employees appreciate receiving accurate and timely paychecks. Using a paycheck creator tool ensures that employees are paid the correct amount, on time, every time. Having the ability to access detailed pay stubs, with all earnings and deductions clearly outlined, can also improve transparency and trust between employees and the HR department.

5. Seamless Record Keeping

Most free paycheck creators offer the ability to store pay stubs and paycheck records digitally. This makes it easier for HR teams to maintain an organized payroll history and provides employees with easy access to their pay information whenever needed. Digital records are easier to search, manage, and share compared to paper-based systems.

Features to Look for in a Free Paycheck Creator

While free paycheck creator tools offer great functionality, not all tools are created equal. Here are some key features HR teams should look for in a paycheck creator tool:

1. Customizable Paycheck Stubs

A good paycheck creator should allow HR teams to customize pay stubs to include the company’s name, logo, address, and other relevant details. Customization ensures that the pay stubs look professional and align with the company’s branding.

2. Multiple Pay Structures

HR teams often handle employees with different pay structures—hourly, salaried, and commission-based workers. The paycheck creator should be versatile enough to handle these various types of compensation. It should also be able to calculate overtime and tips, if applicable.

3. Built-in Tax Calculations

A key feature to look for in a paycheck creator is built-in tax calculations. The tool should automatically calculate federal, state, and local taxes, including Social Security, Medicare, and unemployment taxes. This is particularly important for HR teams, as it ensures compliance with ever-changing tax laws.

4. Deductions and Benefits

In addition to taxes, many employees have deductions for health insurance, retirement plans, and other benefits. A paycheck creator tool should allow HR teams to easily add these deductions to each employee’s paycheck. This ensures that pay stubs are accurate and reflect all necessary deductions.

5. Direct Deposit Integration

Some paycheck creators offer integration with direct deposit systems, making it even easier to pay employees electronically. This feature can save time and reduce errors associated with issuing physical checks.

6. Download and Print Options

The ability to download pay stubs in formats like PDF or Excel is essential for record-keeping. HR teams should be able to print paychecks or share them digitally with employees. This feature provides convenience and makes it easier to distribute pay stubs quickly.

7. Cloud Storage and Security

For HR teams, maintaining secure records is critical. Many free paycheck creator tools offer cloud-based storage, so you can access past paychecks from any device. Make sure the tool has encryption and other security measures to protect sensitive payroll data.

Tips for Using Free Paycheck Creator Tools Effectively

Now that you understand the benefits and features of free paycheck creator tools, here are some practical tips to help HR teams make the most of these tools:

1. Stay Organized

Even though paycheck creator tools automate many tasks, it’s important to stay organized. Ensure that all employee details—such as tax filing status, benefits selections, and pay rates—are up to date in the system. Regularly review your payroll system to ensure everything is accurate before generating paychecks.

2. Double-Check Information

While paycheck creators do most of the heavy lifting, always double-check the information you input. This includes hours worked, bonuses, deductions, and tax calculations. Small errors in this initial stage can lead to problems later on.

3. Use Paycheck Templates

Many free paycheck creators offer templates to make the process faster. These templates can be especially useful for businesses with a standard payroll structure. Use them to save time and ensure consistency across your pay stubs.

4. Review Payroll Regularly

Set aside time each pay period to review payroll before distributing paychecks. This allows you to catch any potential issues early, rather than dealing with complaints or errors after the fact. A thorough review process helps ensure that employees are always paid accurately and on time.

5. Make Payroll Available Digitally

Make it a practice to provide pay stubs digitally to employees. Not only is this more convenient for everyone involved, but it also saves on paper and printing costs. Ensure employees know how to access their pay stubs online.

6. Backup Payroll Data

Even though cloud storage is secure, it’s always a good idea to back up your payroll data. Keep a local copy of your payroll records to safeguard against any potential data loss or technical issues.

How Free Paycheck Creators Benefit HR Teams

For HR teams, using a free paycheck creator tool can lead to numerous benefits:

- Increased Productivity: Automating payroll tasks saves time, allowing HR teams to focus on other critical areas such as recruitment, employee development, and compliance.

- Reduced Risk of Errors: Automated calculations reduce the likelihood of payroll mistakes, which can lead to fines or employee dissatisfaction.

- Compliance Assurance: By ensuring that all taxes and deductions are handled correctly, free paycheck creators help HR teams stay compliant with tax regulations.

- Improved Employee Relations: Providing employees with accurate and timely pay stubs boosts morale and trust between HR and the workforce.

- Cost-Effective: Free paycheck creators offer a budget-friendly alternative to costly payroll software, making them ideal for small businesses and HR teams with limited resources.

Conclusion

For HR teams, managing payroll is one of the most important yet challenging responsibilities. Fortunately, free paycheck creator tools provide an easy, efficient, and cost-effective solution to streamline payroll management. By automating calculations, improving accuracy, and ensuring compliance, these tools can help HR teams save time, reduce errors, and enhance employee satisfaction.

Whether you’re a small business, a growing company, or a startup, a free paycheck creator tool can be an invaluable asset to your HR department. Take advantage of these tools to simplify your payroll process and ensure that your employees are paid accurately and on time, every time.

Leave a Reply