Freelancers are an essential part of the modern workforce, offering flexibility, creativity, and specialized skills. However, with great freedom comes a greater responsibility to manage their finances. One often overlooked aspect of this financial management is keeping track of paycheck stubs. While paycheck stubs might seem unnecessary for those working independently, they are a critical component in managing your business and financial health.

If you’re a freelancer or thinking about starting your freelancing journey, here’s why keeping track of your paycheck stubs is not only important but necessary.

What Are Paycheck Stubs?

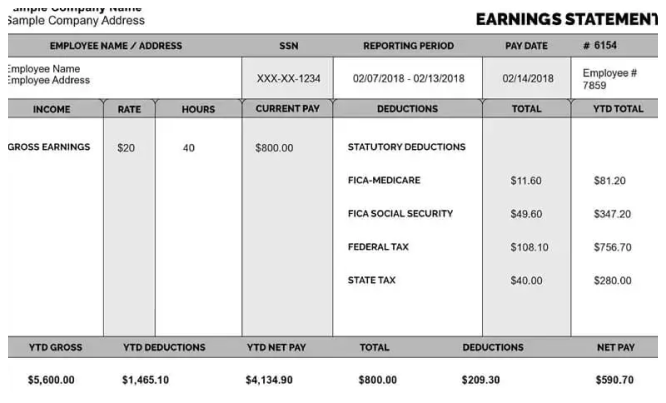

A paycheck stub (also called a pay stub, pay slip, or pay statement) is a document issued by an employer that outlines the details of an employee’s earnings. For freelancers, paycheck stubs provide a breakdown of income, taxes, deductions, and other critical data that can be used to track earnings and ensure accurate reporting.

Unlike salaried employees who get regular paychecks, freelancers are typically paid on a project basis, hourly, or through commissions. This means that the pay structure can vary significantly from one job to another. Even though you might not receive traditional paycheck stubs, it’s still essential to maintain accurate records of your payments. For freelancers, these “pay stubs” can come in the form of invoices, payment confirmations, or bank statements.

1. Tracking Earnings and Cash Flow

As a freelancer, your income can fluctuate from month to month. Some projects may pay well, while others might be smaller or delayed. By keeping track of paycheck stubs, whether through physical or digital records, you can ensure that you have an accurate record of all income received.

By having a clear overview of your earnings, you can assess your cash flow, understand your income patterns, and plan accordingly. This will also help you forecast future earnings and manage potential gaps between projects.

Additionally, tracking paycheck stubs helps you avoid missing payments or discrepancies. If a client forgets to pay or there’s an issue with the payment process, having a record of the transaction helps you resolve the situation quickly.

2. Simplified Tax Filing

One of the biggest challenges for freelancers is managing taxes. Unlike employees who have taxes withheld automatically from their paychecks, freelancers are responsible for calculating and paying their own taxes.

Having paycheck stubs, whether generated from invoices or payments, helps simplify the tax filing process. By keeping track of all payments received, you can easily tally your total earnings for the year. This makes it easier to report your income to the IRS.

Moreover, your paycheck stubs often include the necessary details for tax purposes, such as deductions, fees, and taxes withheld. If you’ve set aside money for estimated taxes, having accurate records can help you determine whether you need to adjust your contributions.

Freelancers may also qualify for certain tax deductions related to their business expenses. By maintaining clear records of earnings and payments, you can cross-reference your income with expenses, making it easier to claim the deductions you’re eligible for.

3. Proof of Income for Loans or Credit

Freelancers may need to provide proof of income when applying for loans, mortgages, or credit cards. Since freelancers do not have a standard W-2 like traditional employees, they can use paycheck stubs or payment records as proof of their financial stability.

Banks and lenders often ask for proof of consistent income to assess your ability to repay loans. By showing them your paycheck stubs or invoices, you provide a clear and credible record of your earnings. Without this documentation, lenders may be hesitant to approve your applications.

Having a reliable way to show your income also helps you avoid the stress of scrambling for documents at the last minute.

4. Tracking Deductions and Expenses

Freelancers may be responsible for paying various expenses, such as business-related costs, equipment, subscriptions, or services used in their work. Paycheck stubs or income records allow freelancers to track these expenses, ensuring they don’t miss anything. For example, if you purchase software for your design work or pay for a coworking space, you need to track these costs.

Your paycheck stubs may also include any deductions made for taxes, retirement plans, or insurance. Having these details readily available helps ensure you’re paying the correct amount and allows you to plan for your business’s financial health.

5. Protecting Yourself Against Payment Disputes

There’s always a possibility that a client might forget or fail to pay you for your work. In some cases, clients may even dispute the amount they owe or refuse to pay altogether. Keeping a record of paycheck stubs, or payment receipts, offers proof that the work was completed and the payment was agreed upon.

With these records, you have leverage in case of payment disputes. You can present clear, organized proof of payment terms and amounts owed. Having this documentation ensures you can protect yourself in situations where a client may try to avoid paying.

6. Organizing Your Finances

Freelancers are essentially running a small business, and as with any business, financial organization is key. By tracking paycheck stubs and maintaining an organized record of your payments, you can avoid feeling overwhelmed when it comes time to balance your accounts.

Keeping track of paycheck stubs enables you to easily categorize income and expenses. This helps you see which areas of your freelance business are most profitable, where you might need to adjust pricing, or if you need to focus on securing more clients.

Effective financial organization also supports good business practices. It helps you manage invoicing, follow up on late payments, and assess your financial progress over time.

7. Ensuring Compliance with Contracts

Freelancers often work with clients through contracts that outline the terms of payment, deadlines, and project details. Keeping track of paycheck stubs helps ensure that clients adhere to these agreements.

For example, if your contract specifies that you will be paid a certain amount for a project by a particular date, having a clear record of the payment (or lack thereof) allows you to refer back to the agreement and hold the client accountable.

In some cases, contracts may specify payment schedules or milestones. Keeping track of paycheck stubs ensures you receive the agreed-upon payments at each stage.

8. Building Your Freelance Career

For many freelancers, building a long-term career requires credibility and professionalism. Keeping accurate financial records, such as paycheck stubs, conveys a sense of organization and responsibility. It shows clients that you take your work seriously and are committed to handling your business affairs properly.

Good financial management makes it easier to set long-term goals for your freelance business. Whether you’re planning to hire employees, expand your services, or save for retirement, tracking your earnings and expenses will give you the information you need to make informed decisions.

9. Utilizing Tools for Tracking Paycheck Stubs

There are many tools available to freelancers to help track paycheck stubs. Invoices and payment platforms, such as PayPal, QuickBooks, or FreshBooks, can automatically generate reports that function similarly to paycheck stubs. These tools help you track income, expenses, and even tax deductions.

For freelancers who prefer physical documentation, keeping paper records and organizing them in filing cabinets or binders can also work. However, digital solutions tend to offer greater flexibility and efficiency.

Many of these tools also offer automated reminders, reports, and financial health analysis, which can help you stay on top of your business finances.

Conclusion

Keeping track of check stubs is crucial to managing your finances as a freelancer. It ensures that you have accurate earnings records, simplifies tax filing, helps secure loans or credit, and protects you from payment disputes. Whether you’re just starting or have been freelancing for years, maintaining a clear and organized financial system will allow you to stay in control of your business and grow it sustainably.

In today’s digital age, there are plenty of tools and methods to keep your paycheck stubs and other financial records organized. Whether you prefer paper or digital solutions, tracking your earnings and payments is a step toward professional success.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

Related posts:

- Why Carpet Cleaning Is Key to a Healthy Living Space

- Men’s Grooming Products Market: Key Trends and Innovations Shaping the Future of Male Personal Care

- 7 Days Glowing Skin Challenge: Expert Tips from Top Skin Specialists in Karachi

- Turkey Activated Carbon Market Breakdown By Size, Share, Growth, Trends, and Industry Analysis

Leave a Reply